Condo Insurance in and around Waukesha

Looking for great condo unitowners insurance in Waukesha?

State Farm can help you with condo insurance

- Wisconsin

- Illinois

- Waukesha County

- Milwaukee County

- Walworth County

- Washington County

- Lake County

- Cook County

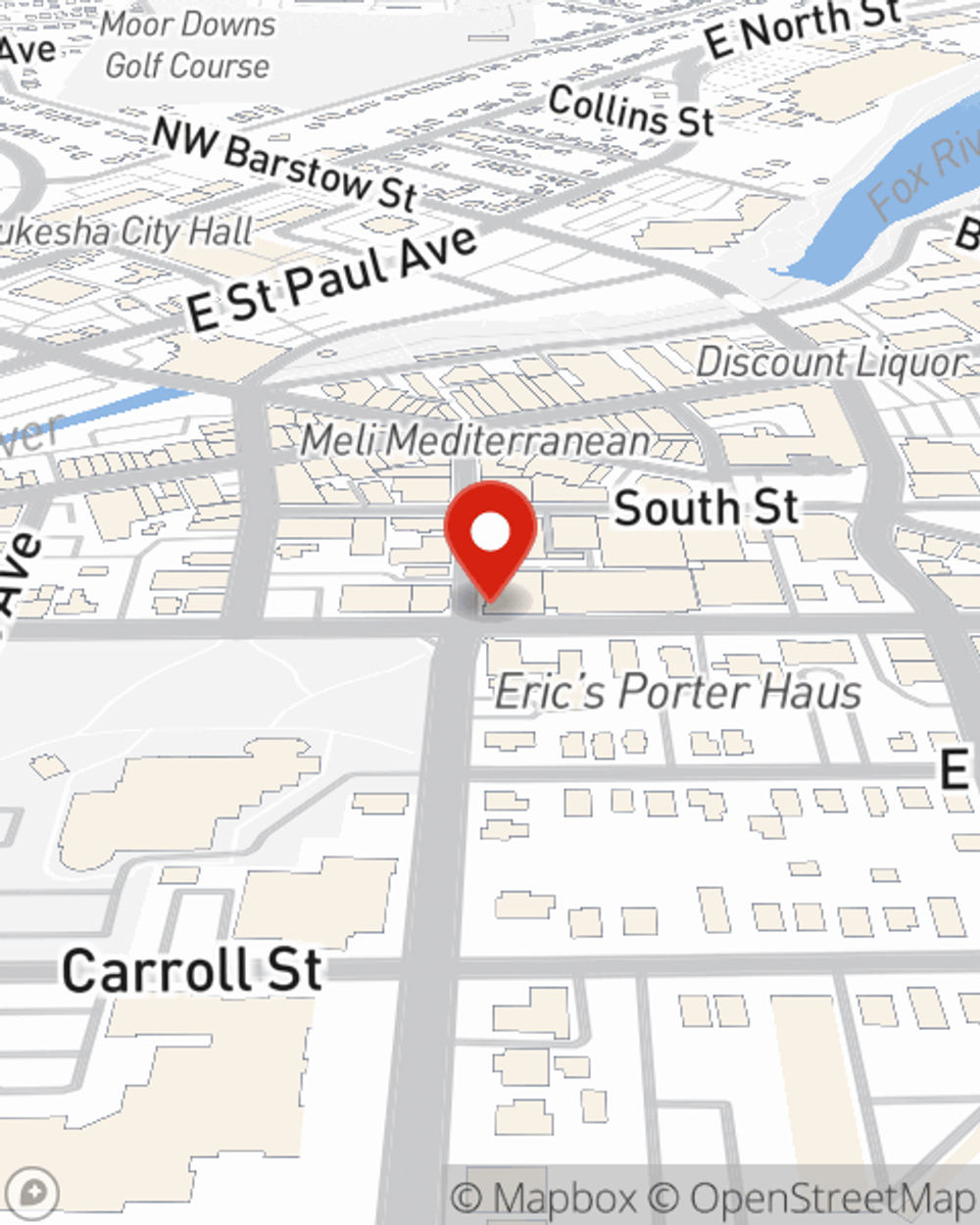

- Waukesha

- Milwaukee

- Brookfield

- New Berlin

- Mukwonago

- Sussex

- Pewaukee

- Delafield

- West Allis

- Wauwatosa

- Elm Grove

- Menomonee Falls

- Michigan

- Minnesota

- Iowa

- Chicago

Calling All Condo Unitowners!

There are plenty of choices for condo unitowners insurance in Waukesha. Sorting through deductibles and savings options can be overwhelming. But if you want budget friendly condo unitowners insurance, choose State Farm for covering your condo and personal belongings. Your friends and neighbors in Waukesha enjoy incredible value and no-nonsense service by working with State Farm Agent Chris Janet. That’s because Chris Janet can walk you through the whole insurance process, step by step, to help ensure you have coverage for your condo as well as pictures, mementos, furniture, sound equipment, and more!

Looking for great condo unitowners insurance in Waukesha?

State Farm can help you with condo insurance

Safeguard Your Greatest Asset

Everyone knows having condominium unitowners insurance is essential in case of a ice storm, windstorm or tornado. Adequate condo unitowners insurance lets you know that you condo can be rebuilt, so you aren’t stuck making payments for a home that isn’t habitable. One important part of condo unitowners insurance is that it also covers you in certain legal cases. If someone gets hurt because of negligence on your part, you could be required to pay for the cost of their recovery or physical therapy. With good condo coverage, you have liability protection in the event of a covered claim.

That’s why your friends and neighbors in Waukesha turn to State Farm Agent Chris Janet. Chris Janet can walk you through your liabilities and help you make sure your bases are covered.

Have More Questions About Condo Unitowners Insurance?

Call Chris at (262) 544-1500 or visit our FAQ page.

Simple Insights®

Condo insurance basics

Condo insurance basics

Condo insurance coverage works in tandem with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

Chris Janet

State Farm® Insurance AgentSimple Insights®

Condo insurance basics

Condo insurance basics

Condo insurance coverage works in tandem with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.